Food Safety Testing Market

Food Safety Testing Market Size, Share, Growth & Industry Analysis, By Testing Type (Pathogen Testing, Genetically Modified Organism (GMO), Allergen, Chemical and Toxin, Other Contaminant Testing), By Technology Type (Polymerase Chain Reaction (PCR), Immunoassay-based, Chromatography, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR590

Food Safety Testing Market Size

The global Food Safety Testing Market size was valued at USD 22.56 billion in 2023 and is projected to reach USD 43.37 billion by 2031, growing at a CAGR of 8.53% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Neogen Corporation, Mérieux NutriSciences Corporation, R-Biopharm, AsureQuality, QIAGEN, SGS SA, Eurofins Scientific, NSF, Bureau Veritas, Intertek Group plc and Others.

The stringent regulations imposed by governments globally to ensure food safety standards and mitigate foodborne illnesses are prominently driving the growth of the food safety testing market. Additionally, increasing consumer awareness and demand for safe and high-quality food products amplify this trend, compelling food manufacturers to invest in comprehensive testing solutions.

The global market is experiencing robust growth driven by a combination of factors. Technological advancements continue to revolutionize testing methods, with rapid diagnostics and automation enhancing efficiency and accuracy. Moreover, the expansion of international trade networks necessitates stringent testing protocols to maintain consumer confidence and ensure compliance with evolving regulatory standards.

Additionally, rising incidences of foodborne illnesses and outbreaks have led to an increase in awareness among stakeholders, prompting proactive measures to enhance food safety practices. This dynamic landscape fosters partnerships and collaborations across the industry to leverage expertise and resources, thereby driving market expansion.

However, challenges persist, including the complexity of testing diverse food matrices and the need for skilled personnel to interpret results effectively. Nonetheless, with increasing globalization and a growing emphasis on health and quality, the market is poised to experience sustained growth in the foreseeable future.

The food safety testing market encompasses the range of products, services, and technologies that are utilized to ensure the safety and quality of food products throughout the supply chain. It includes testing methods such as PCR, immunoassays, and chromatography, targeting diverse food types such as meat, dairy, and processed foods. The growth of the market is driven by stringent regulatory requirements, increasing consumer awareness, and technological advancements facilitating rapid and accurate testing.

Analyst’s Review

Key players operating in the market are actively addressing growth challenges by investing heavily in R&D to develop cost-effective rapid testing solutions for allergens and on-site analysis. Additionally, strategic imperatives such as expansion into emerging markets with rising safety concerns are projected to foster market growth. These players are well-positioned by offering training and expertise on new technologies, thereby addressing the knowledge gap among smaller players.

Furthermore, collaboration with regulatory bodies is crucial for navigating the evolving landscape. By advocating for standardized protocols for new testing methods, companies can ensure wider adoption and maintain their competitive edge in the food safety testing market. Market players are increasingly investing in research and development to innovate new testing solutions, thereby catering to the diverse needs of various food sectors.

Food Safety Testing Market Growth Factors

The shift of consumer preferences toward healthier and more transparent food options is fostering the demand for clean label and minimally processed foods. As individuals become more health-conscious, they are seeking products with simple, recognizable ingredients, free from artificial additives and preservatives. This trend is further fueled by growing concerns regarding the potential health risks associated with processed foods and the desire for greater control over dietary choices. Food manufacturers are responding by reformulating products to align with clean label principles, thereby enhancing consumer trust and creating new market opportunities.

Additionally, regulatory bodies are increasingly advocating for clearer labeling standards, further incentivizing companies to prioritize transparency in their product offerings. The growing emphasis on clean label and minimally processed foods is emerging as a significant factor driving the growth of the market, as it necessitates robust testing protocols to ensure compliance and maintain product integrity.

The evolving food fraud landscape poses challenges for the food safety testing market. As globalization increases and supply chains become more complex, the risk of food fraud, including adulteration, mislabeling, and substitution, has grown significantly. This poses major challenges to public health, consumer trust, and brand reputation.

There is an increased demand for advanced testing methods capable of detecting fraudulent activities and ensuring the authenticity and safety of food products. Technological innovations such as DNA testing, spectroscopy, and blockchain are being utilized to combat food fraud by enabling traceability, authentication, and transparency throughout the supply chain.

Moreover, regulatory agencies are implementing stricter enforcement measures and surveillance programs to deter fraudulent practices. The evolving food fraud landscape underscores the importance of continuous innovation and vigilance in food safety testing to safeguard consumer interests and uphold industry integrity.

Food Safety Testing Market Trends

Advancements in rapid microbiological testing techniques are revolutionizing the food safety testing landscape by offering quicker and more efficient detection of microbial contaminants. Traditional microbiological testing methods often require more time to produce results, causing delays in decision-making processes and potentially allowing contaminated products to enter the market.

Rapid methods such as polymerase chain reaction (PCR), immunoassays, and biosensors, provide results within significantly reduced timeframes, enabling faster response times and more effective control of foodborne pathogens. This trend is driven by the need for real-time monitoring and risk mitigation in the face of increasing food safety concerns and regulatory pressures.

Furthermore, the integration of automation and miniaturization technologies is enhancing the accessibility and scalability of rapid microbiological testing solutions, making them suitable for a wide range of applications across the food industry.

Furthermore, the development of biosensors for food safety monitoring represents a significant trend in the evolution of food safety testing methodologies. Biosensors offer the potential for rapid, sensitive, and selective detection of various contaminants, including pathogens, toxins, and allergens, directly in food samples. These innovative devices typically consist of a biological recognition element (such as enzymes, antibodies, or DNA probes) coupled with a transducer that converts the biochemical signal into a measurable output.

The emergence of nanotechnology, microfluidics, and novel biomaterials has accelerated the development of biosensors with improved sensitivity, specificity, and portability, enabling on-site and point-of-care testing in diverse food production settings. This trend is further fueled by the growing demand for cost-effective and user-friendly testing solutions, which enhance food safety, quality assurance, and regulatory compliance throughout the supply chain.

As biosensor technologies continue to mature and commercialize, they hold the potential to transform the food safety testing market by offering faster, more reliable, and more accessible means of monitoring and ensuring the integrity of food products.

Segmentation Analysis

The global market is segmented based on testing type, technology type, and geography.

By Testing Type

Based on testing type, the market is categorized into pathogen testing, genetically modified organism (GMO), allergen, chemical and toxin, and other contaminant testing. Pathogen testing dominated the food safety testing market, accounting for a valuation of USD 7.61 billion in 2023 primarily due to the increasing incidence of foodborne illnesses and regulatory requirements for pathogen detection. Several factors such as the globalization of food supply chains, changing dietary habits, and the rise in food processing and distribution contribute to an increased risk of microbial contamination.

Additionally, advancements in rapid microbiological testing technologies, such as PCR and immunoassays, have enabled more efficient and accurate detection of pathogens in food products, further driving the demand for pathogen testing services. As consumers prioritize food safety and governments implement stricter regulations, the pathogen testing segment is expected to continue its strong growth trajectory over 2024-2031.

By Technology Type

Based on technology type, the market is classified into polymerase chain reaction (PCR), immunoassay-based, chromatography, and others. The immunoassay-based segment accounted for the largest food safety testing market share of 56.61% in 2023, largely attributed to its widespread adoption and versatility in detecting various contaminants. Immunoassays offer rapid, sensitive, and cost-effective detection of pathogens, toxins, allergens, and other contaminants, making them suitable for a wide range of food products and testing applications.

Additionally, ongoing advancements in technology, such as the development of multiplex assays and portable devices, are enhancing their utility and accessibility in food safety testing. Major factors driving the growth of immunoassay-based testing include increasing consumer demand for safe and quality food products, stringent regulatory requirements, and the need for rapid and reliable testing solutions to mitigate foodborne risks.

Food Safety Testing Market Regional Analysis

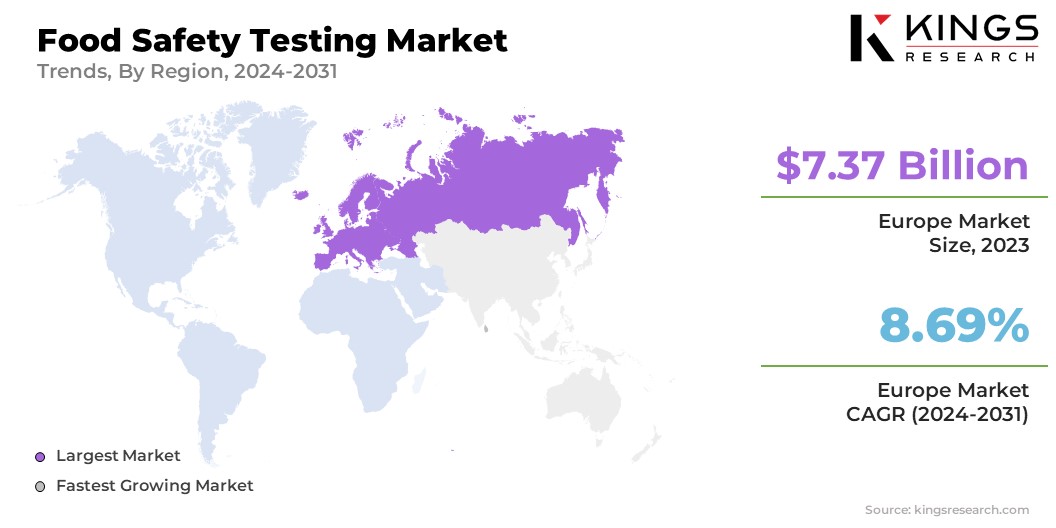

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Food Safety Testing Market share stood around 32.67% in 2023 in the global market, with a valuation of USD 7.37 billion. Stringent regulations, such as the European Union General Food Law, and rigorous enforcement mechanisms ensure a high level of food safety awareness among consumers and producers alike, which are among the prominent factors supporting the regional market growth. This growth is further fueled by a well-established food safety testing infrastructure with a strong presence of leading international testing companies.

Additionally, Europe's mature food processing industry and a growing focus on innovation in food science drive the demand for advanced testing solutions. For instance, Germany's R-Biopharm AG is a leading developer of rapid microbiological testing kits.

Asia-Pacific is projected to experience the highest CAGR of 8.81% over 2024-2031. This surge is fueled by numerous factors such as rising purchasing power of individuals, increasing urbanization, and the proliferation of the e-commerce, along with a growing demand for safe and processed food. Furthermore, several prominent food safety incidents in recent years have raised consumer awareness and prompted government focus on stricter regulations.

- For instance, China implemented a stringent food safety law in 2018, mandating stricter testing procedures. This, coupled with a booming food processing industry, is creating significant growth opportunities for food safety testing companies in the region.

Competitive Landscape

The food safety testing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Food Safety Testing Market

- Neogen Corporation

- Mérieux NutriSciences Corporation

- R-Biopharm

- AsureQuality

- QIAGEN

- SGS SA

- Eurofins Scientific

- NSF

- Bureau Veritas

- Intertek Group plc

Key Industry Developments

- March 2023 (Acquisition) – SGS SA acquired testing operations and assests from Asnecruz, a company based in Spain. Asmecruz, established in 2012, operates a laboratory that provides a wide array of microbiological and biotoxins analysis services and is fully authorized for seafood testing.

- August 2023 (Acquisition) - Eurofins expanded its presence through the acquisition of Exova’s food, water, and pharmaceutical products testing laboratories in the UK and Ireland. This strategic move reinforces Eurofins' footprint in food and water testing in the region and provides an entry point for the implementation of its globally-recognized expertise in pharmaceutical products testing in the UK.

The Global Food Safety Testing Market is Segmented as:

By Testing Type

- Pathogen Testing

- Genetically Modified Organism (GMO)

- Allergen

- Chemical and Toxin

- Other Contaminant Testing

By Technology Type

- Polymerase Chain Reaction (PCR)

- Immunoassay-based

- Chromatography

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership